child tax credit september 2020

The letters were similar to notices the agency sent in September. IR-2021-188 September 15 2021.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22957800/1235261204.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

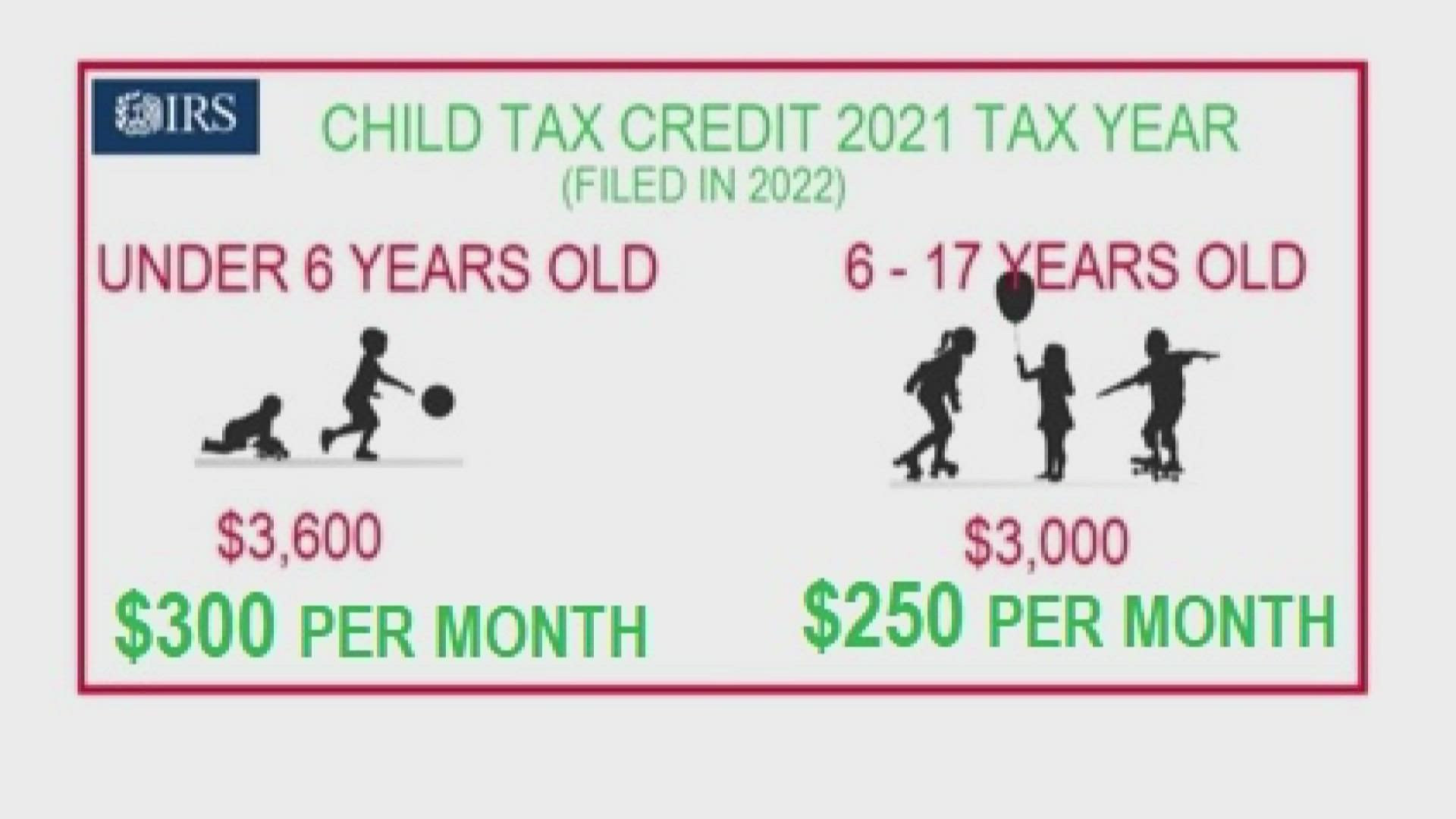

Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17.

. The American Rescue Plan which I was proud to support expanded the Child Tax Credit to provide up to 3600 for children under the age of 6 and 3000 for children under the. August Is Valley Fever Awareness Month. For example if you had a much.

Although there are some similarities the 2021 child tax credit differs significantly from the 2020 allowance. 6 min read. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

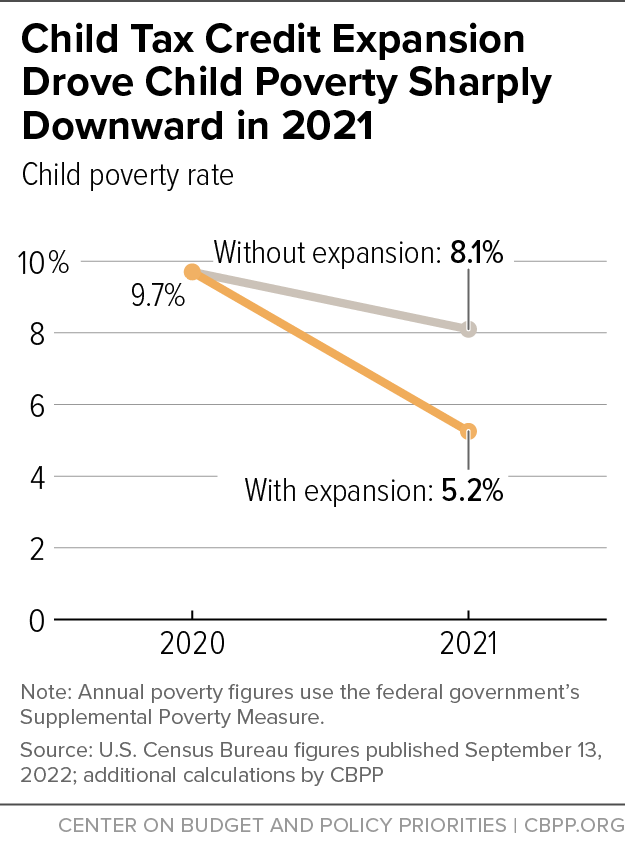

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. The expanded program helped tens of millions of kids and their families amid the COVID pandemic and contributed to a 46 decline in child poverty since 2020 according to.

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

If youve filed tax returns for 2019 or 2020 or if you signed. It is a partially refundable tax credit if you had earned income of at least 2500. Married couples filing a joint return with income of 150000 or less.

For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. Here is some important information to understand about this years Child Tax Credit. The credit amount was increased for 2021.

Users will need a copy of their 2020 tax return or. Occupational Health Watch September 2016. First the credit increases from 2000 for children under.

Users will need a copy of their 2020 tax return or. Millions of families across the US will be receiving their third. The Child Tax Credit provides money to support American families.

To be a qualifying child for. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Who is Eligible.

Filed a 2019 or 2020 tax return and. The child tax credit included up to 3600 for children under age 6 and 3000 per child ages 6 through 17. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Most families are eligible to receive the credit for their children. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Occupational Health Watch July 2016.

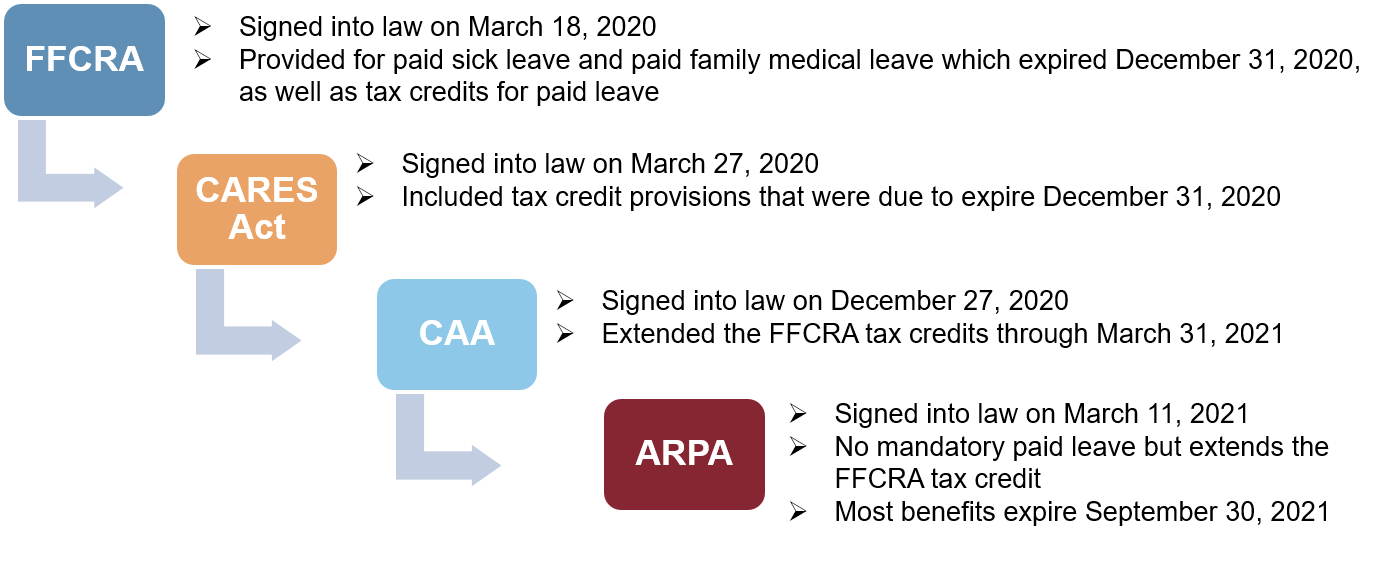

Key Takeaways For Employers The Arpa S Expanded Sick Family Medical Leave And Cobra Benefits Eckert Seamans

The American Families Plan Too Many Tax Credits For Children

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Wcnc Com

September Child Tax Credit Payment How Much Should Your Family Get Cnet

About The Child Tax Credit Momsrising

The 2021 Child Tax Credit Implications For Health Health Affairs

Increasing The Child Tax Credit Marketplace

Study Millions More Kids Are In Poverty Without The Monthly Child Tax Credit Npr

U S Energy Information Administration Eia Independent Statistics And Analysis

The American Families Plan Too Many Tax Credits For Children

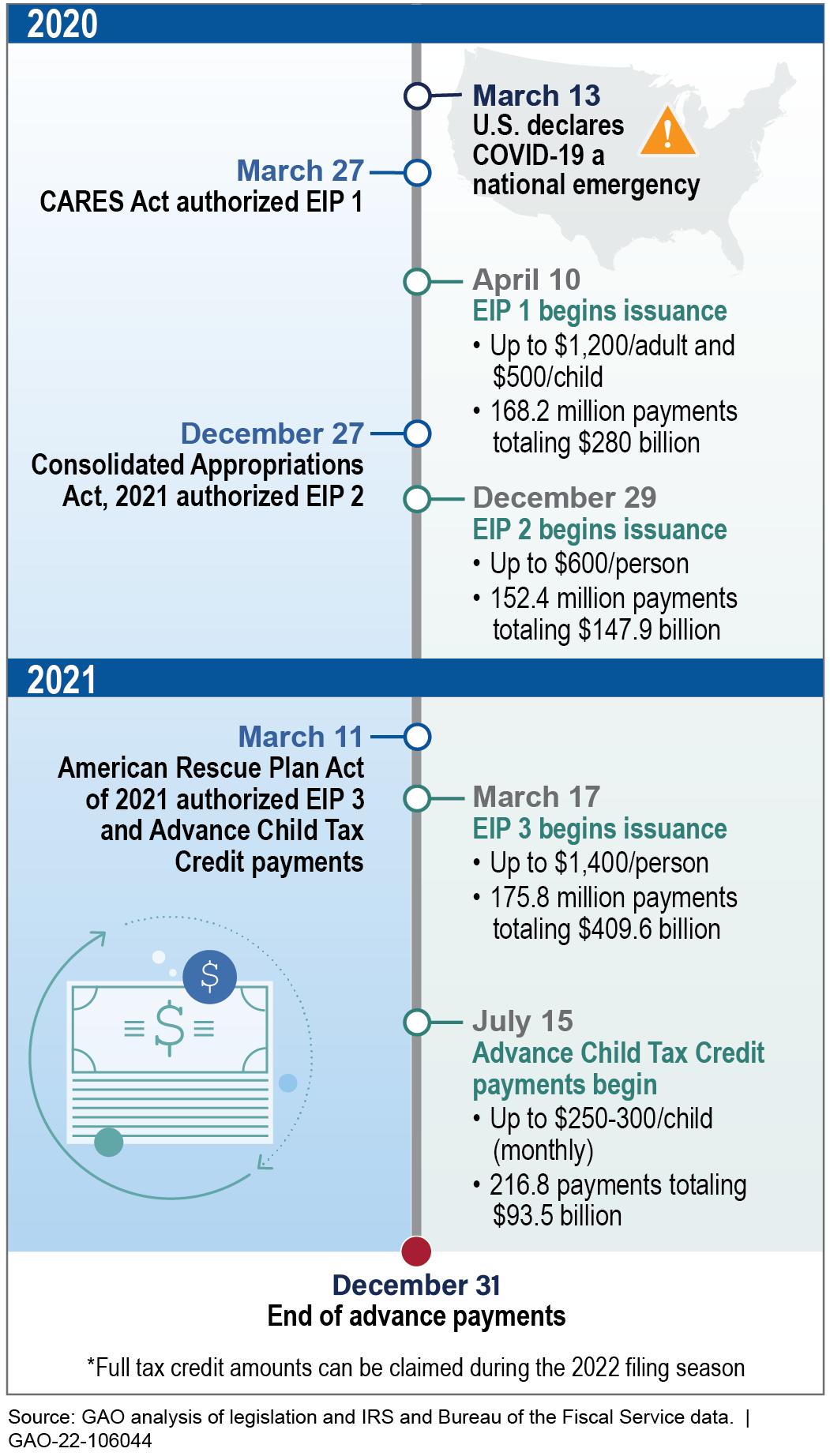

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

Child Tax Credit Some Seeing Delay In September Payment

Child Tax Credit Improvements Must Come Before Corporate Tax Breaks Center For American Progress

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Optima Newsletter Archives Optima Tax Relief

Child Tax Credit Payment Schedule For 2021 Kiplinger

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy